what are the three activities according to which a statement of cash flows is organized

12.ii Three Types of Cash Menses Activities

Learning Objective

- Draw the three categories of cash flows.

Question: What are the 3 types of cash flows presented on the statement of cash flows?

Respond: Cash flows are classified as operating, investing, or financing activities on the argument of cash flows, depending on the nature of the transaction. Each of these 3 classifications is defined equally follows.

- Operating activitiesA section of the argument of greenbacks flows that includes greenbacks activities related to internet income, such every bit greenbacks receipts from sales revenue and cash payments for merchandise. include greenbacks activities related to net income. For example, cash generated from the sale of goods (revenue) and greenbacks paid for merchandise (expense) are operating activities considering revenues and expenses are included in net income.

- Investing activitiesA section of the statement of cash flows that includes cash activities related to noncurrent assets, such as greenbacks receipts from the sale of equipment and greenbacks payments for the purchase of long-term investments. include cash activities related to noncurrent assets. Noncurrent avails include (ane) long-term investments; (2) property, plant, and equipment; and (3) the principal corporeality of loans made to other entities. For case, greenbacks generated from the auction of state and greenbacks paid for an investment in another company are included in this category. (Note that interest received from loans is included in operating activities.)

- Financing activitiesA section of the statement of cash flows that includes cash activities related to noncurrent liabilities and owners' equity, such equally cash receipts from the issuance of bonds and cash payments for the repurchase of common stock. include cash activities related to noncurrent liabilities and owners' disinterestedness. Noncurrent liabilities and owners' equity items include (1) the principal amount of long-term debt, (2) stock sales and repurchases, and (3) dividend payments. (Note that interest paid on long-term debt is included in operating activities.)

Figure 12.1 "Examples of Cash Flows from Operating, Investing, and Financing Activities" shows examples of greenbacks flow activities that generate greenbacks or require cash outflows within a period. Effigy 12.ii "Examples of Cash Menstruation Activity by Category" presents a more comprehensive list of examples of items typically included in operating, investing, and financing sections of the statement of cash flows.

Figure 12.two Examples of Cash Flow Activity by Category

*Receipts of greenbacks for dividends from investments and for interest on loans made to other entities are included in operating activities since both items relate to net income. Likewise, payments of cash for interest on loans with a bank or on bonds issued are besides included in operating activities considering these items as well relate to cyberspace income.

Question: Which department of the argument of greenbacks flows is regarded by most financial experts to be most important?

Answer: The operating activities section of the argument of greenbacks flows is generally regarded as the near important section since information technology provides cash menses data related to the daily operations of the concern. This section answers the question, "how much cash did we generate from the daily activities of our core business organisation?" Owners, creditors, and managers are nigh interested in cash menstruum generated from daily activities rather than from a sometime issuance of stock or a one-time sale of land. The operating activities section allows stakeholders to appraise the ongoing viability of the visitor. We talk over how to apply cash flow information to evaluate organizations later in the chapter.

Business organization in Action 12.2

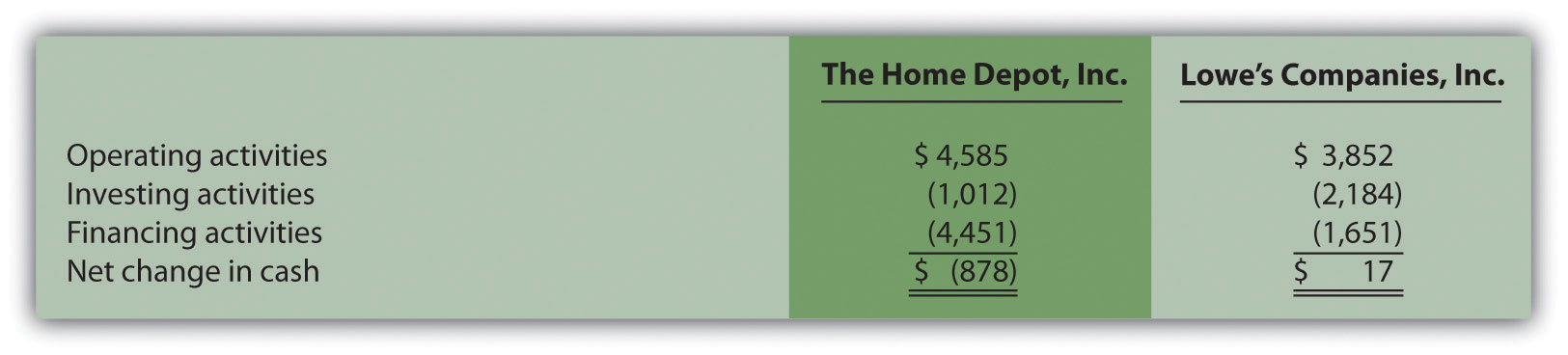

Cash Action at Dwelling Depot and Lowe's

The Home Depot. Inc., and Lowe'southward Companies, Inc., are large habitation improvement retail companies with stores throughout Northward America. A review of the statements of cash flows for both companies reveals the following cash activity. Positive amounts are cash inflows, and negative amounts are cash outflows.

Amounts are in millions.

This information shows both companies generated significant amounts of cash from daily operating activities; $4,600,000,000 for The Domicile Depot and $3,900,000,000 for Lowe's. It is interesting to annotation both companies spent significant amounts of greenbacks to acquire property and equipment and long-term investments as reflected in the negative investing activities amounts. For both companies, a pregnant corporeality of greenbacks outflows from financing activities were for the repurchase of mutual stock. Apparently, both companies chose to return cash to owners by repurchasing stock.

Primal Takeaway

- The three categories of greenbacks flows are operating activities, investing activities, and financing activities. Operating activities include cash activities related to net income. Investing activities include cash activities related to noncurrent assets. Financing activities include cash activities related to noncurrent liabilities and owners' equity.

Review Problem 12.2

Identify whether each of the following items would appear in the operating, investing, or financing activities section of the statement of cash flows. Explain your answer for each item.

- Greenbacks payments for purchases of merchandise

- Greenbacks receipts from sale of common stock

- Greenbacks payments for equipment

- Greenbacks receipts from sales of goods

- Cash dividends paid to shareholders

- Cash payments to employees

- Greenbacks payments to lenders for interest on loans

- Cash receipts from collection of primary for loans fabricated to other entities

- Cash receipts from issuance of bonds

- Cash receipts from collection of interest on loans made to other entities

Solution to Review Problem 12.2

- It would appear as operating activity because trade activity impacts net income as an expense (merchandise costs ultimately menses through cost of appurtenances sold on the income statement).

- Information technology would appear as financing activity because sale of mutual stock impacts owners' equity.

- Information technology would appear as investing action because buy of equipment impacts noncurrent assets.

- Information technology would appear as operating activity because sales activity impacts net income equally revenue.

- It would appear as financing activity because dividend payments impact owners' equity.

- Information technology would appear every bit operating activity because employee payroll activity impacts net income as an expense.

- It would appear as operating activity because interest payments impact net income every bit an expense.

- It would appear as investing activity considering principal collections impact noncurrent assets.

- It would appear as financing activity because bond issuance activity impacts noncurrent liabilities.

- It would appear every bit operating activity because interest received impacts cyberspace income as acquirement.

Source: https://saylordotorg.github.io/text_managerial-accounting/s16-02-three-types-of-cash-flow-activ.html

0 Response to "what are the three activities according to which a statement of cash flows is organized"

Enregistrer un commentaire